Pardon Our Dust

We recently launched this new site and are still in the process of updating some of our archived content. Some details of this article may be incomplete, links may be broken, and other elements may not display properly yet. We appreciate your patience and understanding.

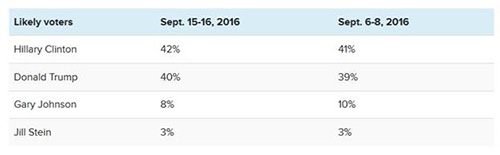

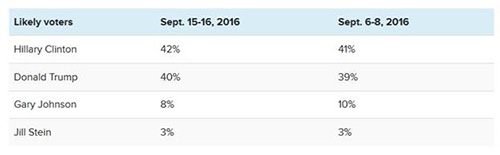

PRESIDENTIAL POLL FOR THE WEEK

Last week was a bad week for Hillary Clinton. But the Democratic presidential nominee is still ahead of Donald Trump in the latestpoll conducted by Morning Consult. In a four-way race, Clinton leads Trump by two percentage points:

Source: Morning Consult

LEGISLATIVE LANDSCAPE

CR-nara Congress, Part II: Senate leaders are still working to finalize anagreement on the CR—the stopgap government fundingmeasure is expected to run from Oct. 1 through Dec.9. On Sept. 19, the Senate postponed a keyprocedural vote as lawmakers and their staffcontinued to hash out the details of a deal. Thecloture vote on the motion to proceed H.R. 5325, thelegislative vehicle for the CR package, is nowscheduled…

Senate Finance to Hold Markup of Pension Bills. Senate Finance Committee Chairman Orrin Hatch (R-UT) and Ranking Member Ron Wyden (D-OR) announced a markup of two pension relatedbills, the Miners Protection Act of 2016 and the Retirement Enhancement and Savings Act of 2016, on Sept. 21…

House Freedom Caucus v. John A. Koskinen: An Impeachment Story. Internal Revenue Commissioner John Koskinen got a reprieve last week when moderate Republicans in the House convinced theirconservative colleagues to postpone a vote to impeach Koskinen. Conservatives of the House Freedom Caucus will now get a formalimpeachment hearing via the House Judiciary Committee. Both moderate and conservative Republicans consider the postponement a“victory.” House leaders breathed a sigh of relief, as they saw the doomed…

Ways and Means to Hold Markup of Tax Legislation. The House Ways and Means Committee has announced that it will hold a markup of tax legislation on Wednesday, Sept. 21 at 2 p.m. in1100 Longworth. The markup agenda includes the following bills…

House to Consider Miscellaneous Tax Bills. The House is taking up a slew of minor bills this week. Of note are the four bills approved by the Ways and Means Committee lastweek…

Ways and Means Subcommittee Holds Hearing on College Endowments. On Sept. 13, House Ways and Means Subcommittee onOversight convened a hearing to explore ways toreduce the cost of a college education. The hearingfocused on the actions that a select group ofcolleges have taken, using their tax-exempt statusto make tuition more affordable. Members from bothparties highlighted the importance of this issue tomiddle class Americans, as the national student loandebt recently surpassed the $1 trillion mark…

REGULATORY WORLD

Try, Try Again. Baker & McKenzie LLP recently sued the Treasury Department under theFreedom of Information Act to get informationabout the 1982 version of earnings stripping regulations. Baker & McKenzie believes that the Treasury Department has improperlywithheld documents that contain the IRS’ views on how far the agency could go in combating earnings stripping. The documents alsoreportedly include the IRS’s statutory mandate under I.R.C. § 385…

A Prelude to Final Regulations. As the IRS continues to fine-tune the final rules on the types of income that qualify an entity to be considered a master limitedpartnership, two private letter rulings may contain a preview of the final regulations. Specifically, in PLR 201636025 and PLR201636039, the IRS noted that interest rate hedging and a regasification terminal generate income that still allow an entity to beclassified as a MLP…

Two Bites Out of Apple. In a Sept. 15 Notice (2016-52), the Treasury Department and the InternalRevenue Service announced their intent to issue regulations under I.R.C. § 909 to address the ability of multinational entities(MNEs) to lower their U.S. tax obligations by claiming a foreign tax credit for taxes paid abroad…

Bad Things Come in Threes. After a $14.6 billion tax ruling and backlash from the release of its new wireless headphones, Apple has been slammed again. Now,Japanese authorities have slapped the company with a back tax bill of $118 million for a failure to pay sufficient withholding taxon royalties to an Irish holding company…

LINE ITEMS

-

How Donald Trump will tax passthrough entities is still an open question. His campaign’s recent two-step on the issue is confusing the analysts at the Tax Foundation. The campaign told the National Federation of Independent Business that Trump would tax passthroughs and corporations at the same rate, 15 percent. However, Trump’s policy team gave the Tax Foundation a different story, saying that the candidate is dropping the proposal. Read more.

LOOKING AHEAD

Congressional Activity

Tuesday, 9/20

Senate Banking Committee

The full committee holds a hearing on “An Examination of Wells Fargo’s Unauthorized Accounts and the Regulatory Response.”Witnesses include: John Stumpf, chairman and CEO of the Wells Fargo & Company; Comptroller of the Currency Tom Curry; RichardCordray, director of the Consumer Financial Protection Bureau; and James Clark, chief deputy in the Office of the Los Angeles CityAttorney, testify

Wednesday, 9/21

Senate Finance Committee

The full committee meets for a markup of two pension related bills, theMiners Protection Act of 2016 and the Retirement Enhancement and Savings Act of 2016.House Financial Services Committee

Capital Markets and Government Sponsored Enterprises Subcommittee holds a hearing on “Corporate Governance: Fostering a System thatPromotes Capital Formation and Maximizes Shareholder Value.”House Judiciary Committee

The full committee holds a hearing on the allegations of misconduct and articles of impeachment filed against IRS Commissioner JohnKoskinen.House Ways and Means Committee.

The full committee holds a markup of various tax legislation. Wednesday’s Full Committee markup is a continuation of theSeptember 14 markup.

Thursday, 9/22

House Financial Services Committee

The full committee holds a hearing on “The Annual Report of the Financial Stability Oversight Council.”House Financial Services Committee

Capital Markets and Government Sponsored Enterprises Subcommittee holds a hearing “Examining the Agenda of Regulators, SROs(self-regulatory organization), and Standards-Setters for Accounting, Auditing, and Municipal Securities.”House Education and the Workforce Committee

The Health, Employment, Labor, and Pensions Subcommittee holds a hearing on “Discussion Draft to Modernize Multiemployer Pensions.”

Friday, 9/23

House Financial Services Committee

The Monetary Policy Subcommittee holds a hearing on “The Financial Stability Board’s Implications for U.S. Growth andCompetitiveness.”

Agency Activity

Tuesday, 9/20

FDIC

The Federal Deposit Insurance Corporation (FDIC) holds a meeting to consider Memorandum and resolution re: Notice of ProposedRulemaking: Establishing Restrictions on Qualified Financial Contracts of Certain FDIC-Supervised Institutions; Revisions to theDefinition of Qualifying Master Netting Agreement and Related Definitions; Memorandum and resolution re: Regulatory Capital Rules,Liquidity Coverage Ratio; Revisions to the Definition of Qualifying Master Netting Agreement and Related Definitions; Memorandumand resolution re: Designated Reserve Ratio for 2017; Summary reports, status reports, reports of the Office of Inspector General,and reports of actions taken pursuant to authority delegated by the Board of Directors.Federal Reserve Board

The Federal Open Market Committee (FOMC) holds a closed meeting, beginning at 9 a.m. The FOMC is the policy-making arm of theFederal Reserve, September 20-21.

Thursday, 9/22

Financial Stability Oversight Council

Secretary Lew will preside over an executive session of the Financial Stability Oversight Council (Council) at the TreasuryDepartment. The preliminary agenda includes an update on the Council’s review of asset management products and activities;consideration of the Council’s fiscal year 2017 budget; a discussion of a potential proposal by the Office of Financial Research toestablish a permanent collection of repurchase agreement data; an update on the Shared National Credit Program; and an update ondevelopments regarding the resilience, recovery, and resolution of central counterparties.

Other Activity

Monday, 9/19

SIFMA

Join SIFMA for another C&L Society Regional Seminar on September 19 at the Ritz-Carlton in Charlotte, North Carolina. This oneday seminar will feature presentations by leading securities regulators and industry professionals.Read more.

The National Association of Federal Credit Unions holds its 2016 Congressional Caucus, September 19-21.Ginnie Mae

Ginnie Mae holds its fourth annual summit to address the future of the government in housing finance. Participants include: GinnieMae President Theodore Tozer; and Mark Zandi, chief economist at Moody’s Analytics.

Tuesday, 9/20

Center for American Progress

The Center for American Progress (CAP) holds a discussion on “Toward a Sustainable Economy: Transparency, Long-Termism, and theSecurities and Exchange Commission (SEC).” Participants include: Sen. Jeff Merkley, D-Ore.; Tyler Gellasch, former counsel to theSEC commissioner; Angela Hanks, associate director for workforce development policy at CAP; Morris Pearl, former businessexecutive; Cheryl Smith, managing partner at Trillium Asset Management; Cynthia Williams. chair in business law at the Osgoode HallLaw School; and Andy Green, managing director of economic policy at CAP

Thursday, 9/22

Taxpayers for Common Sense

Taxpayers for Common Sense holds a discussion on “Showdown at Gucci Gulch Revisited: Lessons Learned from 1986 Tax Reform,”focusing on “the obstacles faced – then and now – to passing comprehensive tax reform.”

For listings of all the week’s tax and financial services happenings, read below to find out how you can become a subscriber.

The McGuireWoods’ Tax & Financial Services Policy Group assists clients in understanding how the latest legislative and regulatory proposals anddecisions may impact their business and industry. To learn more about how our team can help you monitor, analyze, and navigate all relevant legislativeand regulatory developments, please contact any of our attorneys and consultants below at (202) 857-1700. For more information on how to subscribe toour weeklyTax Policy Update and tax news alerts, please contact Radha Mohan, rmohan@mwcllc.com, (202) 857-2944.

Lai King Lam